A focus on food scarcity

Paul Dennis, Investment Director, analyses the global food situation.

Ukraine’s bright blue and yellow flag has become a common symbol around the globe, used to show our solidarity with the country and its people as they experience the horrors of war. Until now, not many of us knew that it represents a golden field of wheat beneath a blue sky – perfect for the country known as “the breadbasket of Europe.”

Today, Russia is the largest exporter of wheat and Ukraine is the fifth-largest. Combined, they provide nearly 30% of all annual wheat sales.1 Most of this wheat is imported by countries in the Middle East and North Africa. For example, Lebanon and Tunisia are highly dependent on Ukrainian wheat, with it accounting for more than half of their supply 2 and Egypt is the world’s largest importer. 3 In addition to wheat, Ukraine is a big exporter of corn, poultry meat, and vegetable oils.

We’ve previously written about fuel dependency on Russia, but, as the horrific war rages on, the widespread reliance on this part of the world for basic food commodities could lead to additional humanitarian crises around the globe and increasing prices for everyone.

Impact on production and supply

Since the invasion, Ukraine has suspended exports of rye, oats, millet, buckwheat, salt, sugar, meat and livestock and introduced licences for wheat, corn and sunflower oil exports.4 Now is a critical time in the year for crop planting, and President Zelensky has urged farmers to plant as much as possible.5 However, clearly a country in the grips of war will have significant challenges to continuing farming as usual, meaning that future harvests will be impacted too.

Effects in production will be more marked on spring sown crops, such as sunflower seed, rather than winter sown crops, such as wheat, that went in the ground before the invasion. A drop of 4.7 million hectares in spring cropping has been anticipated.6

Compounding factors affecting global markets

Reduced food output from Ukraine is inevitable for two reasons. First, reduced plantings leading to lower overall production but there is also the difficulty of physically exporting seeds and grain onto world markets. This arises at a time when global stocks of food are lower than usual (due to the pandemic, supply chain issues and a shortage of moisture on the US plains).

Meanwhile, the costs of all food production will be impacted by soaring diesel and energy prices leading to more expensive production, transport, food processing and distribution. The price of fertiliser has rocketed too – Russia is a major exporter of crop nutrients and has temporarily suspended exports.7 In addition, the EU has moved to sanction imports of Russian potash – a key ingredient in fertiliser.8

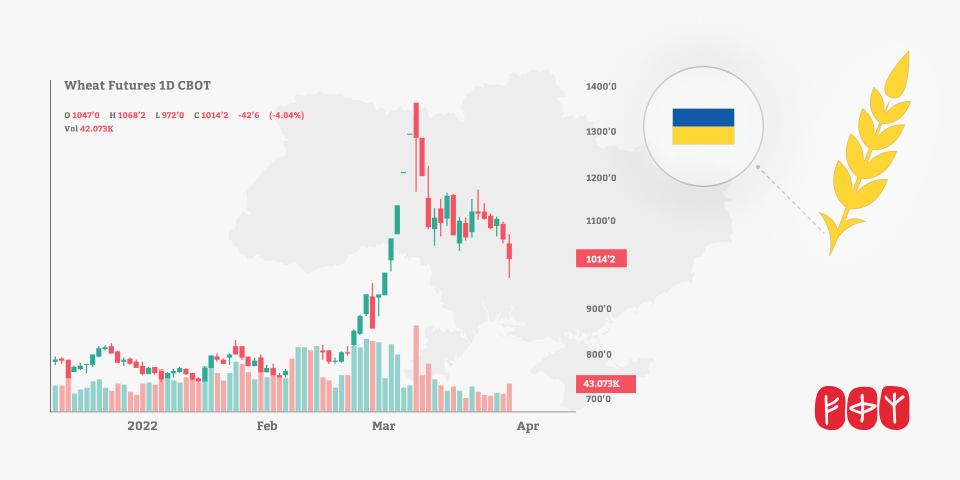

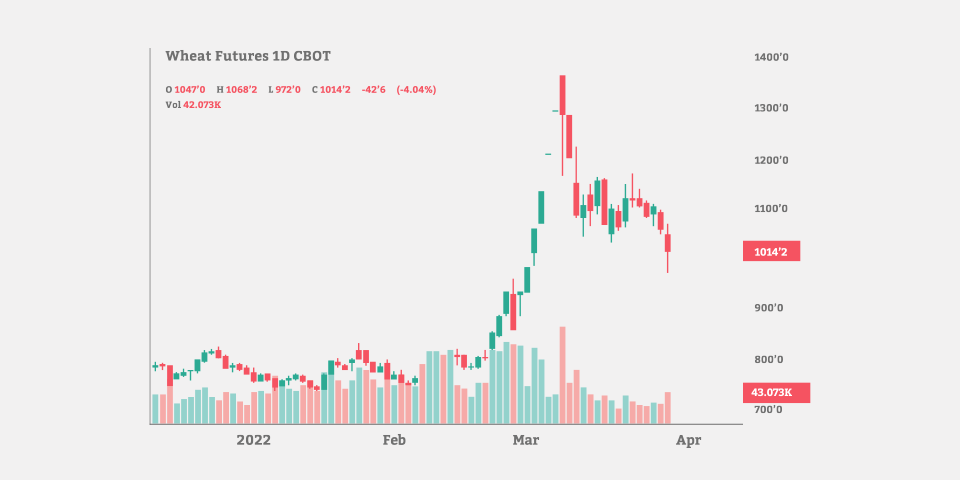

These factors combine to make providing affordable food increasingly challenging. Globally, food is 20 percent more expensive now than it was a year ago, with prices rising four percent since January this year.9 The impact of the Russian invasion on Ukraine can be clearly seen in this chart of London wheat price futures:

https://www.livecharts.co.uk/MarketCharts/wheat.php

Price rises will affect everyone, but the proportion of income already spent on food, will make the difference as to whether people can absorb the cost by spending less in other ‘non-essential’ areas, or whether they will face a food crisis.

Food scarcity risk

For less developed countries and poorer households, the amount of income spent on food can already exceed 40%, making further price increases incredibly challenging. Countries such as Lebanon, Egypt and Yemen will be forced to import grain at a higher cost, impacting on the cost of bread and other foodstuffs.10

Africa is anticipating reduced crop yields in the coming season, which may result in food shortages in some of the poorest regions of the world at a time when prices are soaring for imports.11

Avoiding sanctioning Russian food exports would help to an extent, and the G7 agricultural ministers also advise countries to avoid export bans that would restrict movement of food out of their country.12 Yet with the rising cost of energy adding to the problems, developed countries will need to be aware of the risk of humanitarian crises globally.

In the UK

In the UK, food self-sufficiency has dwindled to 60%. Many of the UK’s farmers are enrolled in agri-environment schemes and have reduced food production or are not growing food at all. The government has a target of protecting 30% of land for nature by 2030, which could further reduce self-sufficiency.13

Clearly, balancing the protection and enhancement of biodiversity and habitats with a reliable domestic food supply is the great challenge facing British farming policy. Meanwhile, the Trussell Trust food banks reports increasing demand as people in extreme poverty are unable to afford food14 and are even avoiding potatoes and root vegetables from the foodbank due to the cost of cooking them.15

The future

Just as the energy crisis highlights our reliance on dirty fossil fuels, the food crisis shows the need to transform our food system making it more localised and resilient. The complacency that has arisen in much of Europe has been based on a belief that abundant food is available globally and that those with money can rely on imports to meet their needs. That complacency is being challenged.

We need more green energy, sustainable diets containing fewer grain-fed animal products alongside agricultural practices that enhance soil health and support biodiversity.16 A government commitment to UK food security is essential.

Investing in agriculture

Many of our portfolios support the shift to renewable energy, which helps with making the overall system more sustainable by reducing reliance on fossil fuels. There are also various opportunities for investing with Holden & Partners in ways that address some of the food and farming issues discussed, by supporting the UN’s Sustainable Development Goals (SDGs), such as Zero Hunger.

For example, the WHEB Sustainability fund held in our portfolios invests in Koninklijke DSM. This company creates innovative food and feed supplements for human and animal nutrition, supporting healthy diets, reducing the environmental impacts of food production and resulting in more efficient global food supply chains. The company contributes to SDGs including: Zero Hunger, Good Health and Well-being, Responsible Consumption and Production, Climate Action and Life Below Water.17

Do get in touch if you’d like to discuss your options for sustainable investments in agriculture and food.

Save the Children

Holden & Partners have made a donation to Save the Children to support the work they are doing with children and families who are suffering as a result of the conflict.

We have received lots of positive feedback about our updates. If you’ve found them useful and informative, we would be delighted for you to share them with friends, family and work colleagues. We are always keen to spread the word about our unique approach to financial planning and investing.

Please note that any thresholds, allowances, percentage rates and tax legislation stated may change in the future. The content of this communication is for your general information and use only; it is not intended to address your particular requirements. This communication should not be deemed to be, or constitute, advice. You should not take any action without having spoken with your usual adviser.

1War in Ukraine will cripple global food markets | The Economist

2 How the war in Ukraine will affect food prices (msn.com)

4 Zelensky urges Ukrainian farmers to plant crops (rte.ie)

5 Zelensky urges Ukrainian farmers to plant crops (rte.ie)

6 New crop Ukrainian commodities a market sentiment setter: Grain Market Daily | AHDB

7 Fertiliser price sky-high as Ukraine war worsens energy fears – Farmers Weekly (fwi.co.uk)

8 Higher food prices expected as war in Ukraine adds strain to supply chains (investmentweek.co.uk)

9 How the war in Ukraine will affect food prices (msn.com)

10 How the war in Ukraine will affect food prices (msn.com)

11 Higher food prices expected as war in Ukraine adds strain to supply chains (investmentweek.co.uk)

12 How the war in Ukraine will affect food prices (msn.com)

13 Chris Bennett: Ukraine war highlights food security risk – Farmers Weekly (fwi.co.uk)

14 The Trussell Trust – Stop UK Hunger

16 Ukraine: how the global fertiliser shortage is going to affect food (theconversation.com)