The Value of Financial Planning

It’s one of those annoying phrases often rolled out by teachers around exam time: “If you fail to plan, you are planning to fail!” First said by statesman, inventor and scientist Benjamin Franklin, it’s particularly irritating to hear because it’s usually true.

These are uncertain times, and whilst we can’t always predict the future, we can minimise the risks by planning. Financial planning is there to help you work out if you are on track with your money, whatever happens, so you can relax and get on with life.

But what does financial planning involve, and can you do it yourself? We’ve taken the most common FAQs and shared our answers to help you decide if you need advice.

What is financial planning?

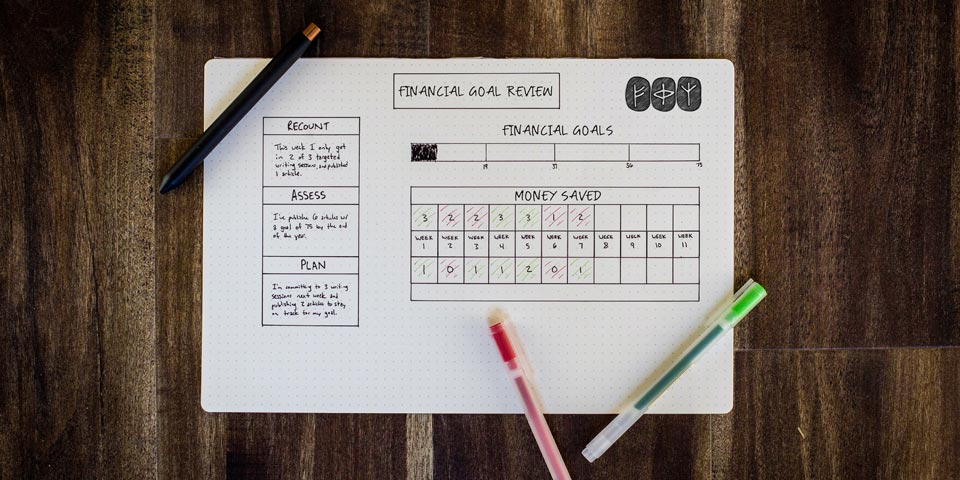

Financial planning evaluates your money situation. It’s a detailed look at everything including your income, expenditure, and savings. Once you have that up-to-date picture, then your financial adviser can create a cashflow plan. This is a graphical representation of your wealth over time that enables you to visualise what your financial future could look like. It adds in variables such as inflation, taxation, and investment growth so you can explore the impact of different scenarios, such as investing more each month or retiring two years early.

If a shortfall is projected, options can be identified to get you back on track to meet your objectives. If you’re on track, your adviser can help identify new opportunities to make the most of your assets and even rethink your goals.

Stefani Williams, financial planner and partner at Holden & Partners, says ‘More and more I see our role as a financial coach. In the same way that a personal trainer would look at your lifestyle and goals and give you a plan to follow to improve your wellbeing, now and in the future, we do the same for your finances.’

What are the benefits of financial planning?

Seeking expert advice can help maximise financial return. A study 1 in 2017 showed that in comparison to a control group who received no advice, those who were advised accumulated on average over £40k more in pensions and investments, net of charges. The research also found that people are more motivated to save and invest when supported.

There are also the peace-of-mind advantages of financial planning. Having a plan and a clear strategy for the future often reduces stress and worry, answering all those ‘What if?’ questions. You might be interested in our recent article on how to achieve financial wellbeing.

Who needs financial planning?

If you haven’t got clear answers to the following questions, you should consider seeking financial planning advice.

- When can I afford to retire with my desired lifestyle?

- How much do I need to save to achieve this?

- Am I taking too much or not enough risk with my investments?

- How do I get the balance right between spending and saving?

- Can I afford a large capital expense such as a home extension, or make gifts to my children?

- Can I meet my goals if my investments fall in value?

- Will my family be OK if I am unable to work, or if I die prematurely?

Are financial planners worth it?

Do you look at the cost of financial planning and think, I can do it myself? If you’ve got the time and the inclination, then it is possible to manage your own finances. However, you miss out on objective advice and the experience of an expert, which can be especially useful when aiming to futureproof your investments.

A good adviser is there to help you make key life decisions that involve your finances, they are there to hand hold and help you protect your family (through life cover, ill-health cover etc). When the need arises, they can assist you in liaising with lawyers and accountants to cut through the jargon and of course, help you achieve tax efficiency.

Achieving positive returns through the investments they make on your behalf is obviously a key objective. It’s important to understand that investment, whether carried out yourself or with an expert, comes with no guarantees, especially in a volatile economic climate. The value of investments can go down as well as up and you may get back less than you invest.

Forming a relationship with a trusted adviser means you have someone on your side, looking out for your money, even when you don’t have time to.

Which financial adviser to choose?

Many of our clients find us through to word of mouth, so seeking recommendations from satisfied friends and family can be a good first step. It’s vital to make sure you use an FCA approved adviser and, for the gold standard, a chartered firm. With most things in life though, its about people. Chat with anyone you are considering working with to see if you feel listened to and understood – both are essential first requirements to making sure your goals can be met.

It’s important to note that an adviser can only provide advice within the limits of their qualifications. For example, a restricted or tied adviser, can only recommend products within a specific range of products that they sell. As a result, they might not be able to recommend the most cost-effective solution. For this reason, we believe an independent financial adviser, who is able to recommend products from the whole of the market, is often best.

Can financial planners give tax advice?

Effective, up-to-date tax advice is a key part of the financial planning process. An adviser will help you answer questions such as:

- Do I make full use of my tax allowances every year?

- Do I have a plan in place to draw my income as tax efficiently as possible?

- Can I gift to family without tax implications?

- Have I made plans to minimise inheritance tax?

- Am I liable for Capital Gains Tax?

They can analyse different solutions and look at the impact not just today, but into the future. It also means that when tax regulations change – just look at the recent restrictions on Capital Gains Tax – you have an expert applying new rules to your situation.

How can financial planning help me achieve my goals?

On a superficial level, financial planning is about ‘protecting and enhancing your wealth’ but at Holden & Partners, we know that what also matters is helping you to achieve the life that you want for you and your family.

Cashflow analysis helps you to plan for big life events, whether they are expected or not, such as six months of travelling, university fees, early retirement, gifting during your lifetime, or receiving an inheritance. It offers valuable insight into how we can help improve your financial security and to identify any steps that need taking to keep you on track.

What happens if?

Advisers don’t shy away from helping you prepare for the trickier bits of life too. Planning ahead for challenging situations such as ill health, job loss, bereavement or needing long term care can bring welcome clarity for yourself and your family if the worst happens.

Can a financial adviser help me with ethical or environmental concerns?

The ethical and environmental investing landscape has expanded in recent years. That means investors have more options when selecting green or ethical funds, but it is also more complex to create a portfolio that truly reflects your concerns and avoids ‘greenwash’. Whether there are areas such as oil and tobacco that you wish to avoid, or if you want to invest in funds that create a positive difference, a financial adviser with expertise in sustainable investing will inform and guide your choices.

For more advice about financial planning or sustainable investing, do get in touch with us.