Lifting the lid on Greenwashing

Greenwashing is a form of marketing spin in which green marketing is deceptively used to persuade the public that an organisation’s products, aims, and policies are environmentally friendly.

Although greenwashing isn’t a new phenomenon – the term has gained broad recognition since the mid-1980s – there has been a huge uptick recently to meet consumer demand for greener products and services 1 as growing public concerns about the environment and the climate have drawn more scrutiny on the environmental impacts of companies. 2 As a result, 66% of consumers are happy to pay more for environmentally friendly products, highlighting the financial incentive for companies to appear sustainable. 3

Today, the market’s definition and interpretation of “sustainable” has now been expanded to incorporate Social and Governance issues as well, thanks to the development of Environmental, Social and Governance (ESG) as an analysis framework. As a result, comments that go beyond simple environmental claims may now be included in greenwashing activity. 4

How do you spot greenwashing?

Due to the misleading claims, lingo, marketing, etc., spotting greenwashing can often be difficult, especially when looking at funds at a high level. While on the surface an investment may appear sustainable, it is not until you look under the bonnet that the greenwashing becomes apparent. Unfortunately for many retail investors, finding this information can be difficult, confusing, and often time-consuming. So, what are some things we can look for to spot greenwashing?

Individual Stocks

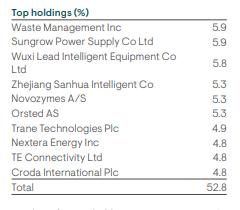

An obvious way to spot greenwashing is by looking at the underlying holdings within the fund. A fund labelled ‘sustainable’ while containing stocks in controversial industries, such as oil & gas, mining, etc. should raise some red flags. Out of the 30-50 stocks most funds hold, it is common for us to disagree on the inclusion of 1 or 2 names, often purely down to differing opinions as ESG investing can be a very subjective area. However, when there are multiple stocks or industries that we feel should not be included, it is a sign that the fund is perhaps not as sustainable as it claims. The fund’s top 10 holdings can usually be found on their website or factsheet.

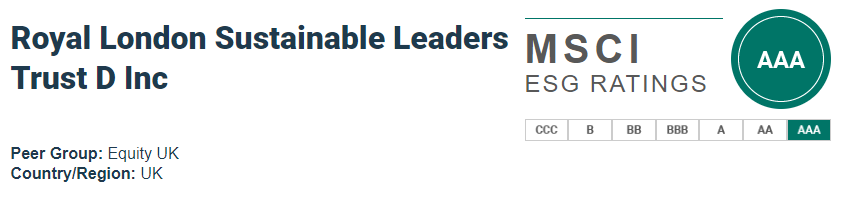

Ratings/Classifications

The world of ESG investing continues to grow, and so do the tools we have at our disposal when carrying out research. There is now a plethora of rating tools available, helping to identify the strong performing companies and collective investments. While each having different methodologies, they all examine ESG credentials to determine their overall sustainability. Areas such as, but not limited to, carbon intensity, board diversity, transparency, etc. are often looked at. Some popular names in this area include Sustainalytics and MSCI, along with many other smaller providers offering these services. While they are useful tools, we use them in conjunction with other methods of research.

Engagement and Voting Records

These two areas are a great way to ascertain if the fund is putting their money where their mouth is. Often being significant stakeholders of companies, fund managers tend to have a degree of influence when it comes to company behaviour and voting. Engagement – a purposeful, two-way dialogue between fund managers and companies – surrounding ESG issues, shows an active approach to creating positive change. This, along with voting at shareholder meetings gives a good idea of a fund’s ESG credentials.

The key things to look at here are:

- Do they disclose engagement and voting activity? This is a red flag if they do not.

- Which areas are the engagement and voting activity focused on? We want to see issues such as emission reductions, worker well-being, improvements in board diversity, etc.

- Is there progress on these issues? It’s all well and good discussing the above areas, but is the progress being tracked? Are there timeframes given?

What do we do to avoid greenwashing?

The market for sustainable investment funds is growing rapidly, and with it comes the risk of greenwashing by a company or asset manager to emphasise a company’s message or attract investment. Therefore, as an investor and a consumer, it pays to be generally sceptical and alive to greenwashing.

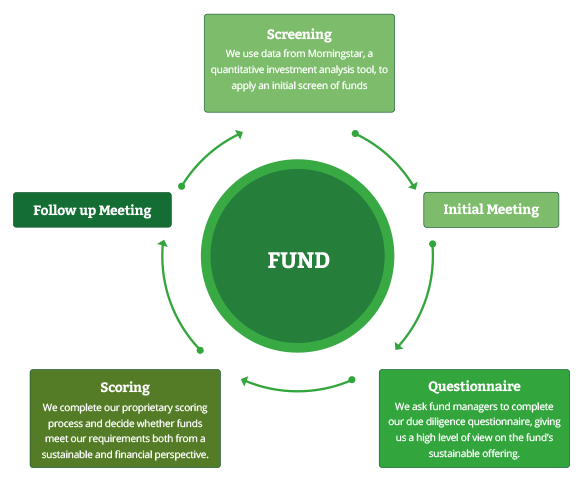

At Holden & Partners, our objective is to create sustainable investment models that incorporate a diverse range of responsible investment strategies, from environmental, social, and governance (ESG) integration to impact funds. To achieve this our investment team uses a thorough quantitative and qualitative selection process for all funds held in our portfolios.

Since ESG metrics are not commonly part of mandatory financial reporting, 5 sustainable investing requires an additional layer of data and analysis compared to traditional strategies. We use data from Morningstar, a quantitative investment analysis tool, to apply an initial screen of funds. Typically, the funds we are screening for fall into three groups: 6

- ESG Incorporation funds make sustainability and ESG factors an important part of the process when selecting portfolio holdings.

- Impact funds’ focus can range from broad sustainability issues to specific concerns aimed at selected areas of interest, such as gender equality and low carbon emissions.

- Sustainable sector funds focus on companies contributing to the transition to a green economy – industries like renewable energy, water, agriculture/food and green real estate.

After conducting a screening, the investment team will meet with the fund managers to get an in-depth overview of the fund. Following the meeting we will ask the fund managers to complete our due diligence questionnaire, giving us a detailed level of information on how the fund operates and incorporate its sustainable offering. We then run our own proprietary scoring process to determine if the funds meet our requirements from both a sustainability and financial perspective. These scores are based on what the ESG aims of the fund are, how these aims are reflected in the investment process, the governance of the fund and the companies they invest in, and how the fund monitors stewardship and engagement.

Sadly, there are bad actors in most markets, especially in those where there is a real financial incentive to appear sustainable and socially conscious. ESG, sustainable and impact investing have many, many shades of grey and can be very subjective. That is why we believe it is important to discuss with our clients what matters to them so that we can align our own goals and ambitions. No company or fund is perfect, but by sticking to our commitment to creating investment strategies that seek to both maximise financial returns and positive sustainable outcomes we know that we can safely navigate away from companies who might be trying to paint too green a picture and support those who are genuinely driving change.

1 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2898878/

2 https://www.greenpeace.org.uk/news/golden-age-of-greenwash/

3 https://www.clientearth.org/what-we-do/priorities/greenwashing/

4 https://corporatefinanceinstitute.com/resources/knowledge/other/greenwashing/