Earth day 2023

“Investing in a green economy is the only path to a healthy, prosperous, and equitable future.” 1 It’s a powerful statement for Earth Day 2023, accompanying the theme of ‘Invest in our planet’. But what does it really mean?

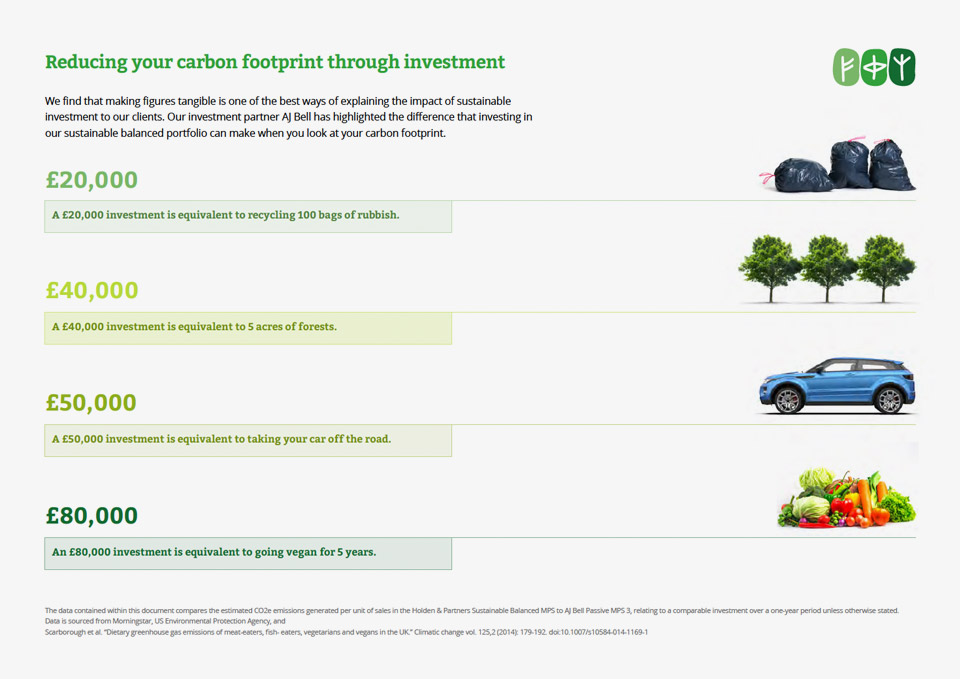

As experts in sustainable investment, the key driving force at Holden & Partners is to invest in our planet. So we’ll take you beneath the surface of Earth Day soundbites and explain how we do this, as well as what you can do as an individual.

Over the years, governments around the globe have implemented many green policy initiatives, but the stark truth remains: Very few countries in the world are on track to achieve greenhouse gas neutrality by 2050.2 In order to keep global warming below the critical 1.5C, immediate and significant action is needed now, and governments can’t do it alone.

A green revolution is required to save humanity from the climate crisis, and building green economies in every country will ensure everyone benefits. Sustainable investment can have the immediate and direct impact that is required, driving the shift away from the fossil fuel economy and out-dated technologies.

For businesses, we are moving to a turning point where there is no longer a choice between going green and long-term profits. Companies who’ve developed strong environment, social and governance (ESG) standards are seeing better profitability, stronger financial performance, and happier employees. 3 Alongside this, consumers are increasingly avoiding brands with poor ethical or sustainable performance.4 For investors, our own research and independent studies reveal that over the longer term, a sustainable portfolio can outperform a more traditional set of investments.5

Paul Dennis, our Investment Director, explains more about Holden & Partners’ sustainable portfolios.

What is sustainable investment?

To us, sustainable investment strategies support development opportunities that should meet the needs of the present without compromising the needs of future generations. We find that most clients we speak to want to know that their investments will not harm people or planet, but what is even more important for them is to actively contribute to positive change. We take this guiding principle into the sustainable portfolios we build.

By putting your money into targeted funds, your investments can work hard to create powerful change, while you go about your daily life. It’s a motivating message for Earth Day that, as individuals, we can invest in our planet.

How is Holden & Partners sustainable?

In every area, from how we run the office, to how we position our portfolios and to the financial advice that we give, we’re sustainable through and through. This is recognised by our B Corp accreditation, which confirms the value we place on sustainable purpose alongside profit. We’re always working on this too – aiming to become greener each year.

What sustainable investments can I make with Holden & Partners?

We seek out investment strategies that align with the United Nation’s 17 Sustainable Development Goals (SDGs).6 The SDGs are ambitious goals designed to unite us all behind a shared ambition, covering areas such as climate action, zero hunger and affordable and clean energy.

Our sustainable portfolio is broad and interesting. Here are some examples to inspire you.

- Ninety One’s Global Environment Fund features in many of our investment portfolios and focuses on sustainable decarbonisation. All companies invested in by the fund generate at least 50% of revenues from environmental means and actively avoid the carbon-based options. This includes a recycling company, biodegradable plastic production and renewable energy grids. The fund supports targets from SDG 7 Affordable and Clean Energy, and SDG 13 Climate Action.

- Stewart Investors’ Asia Pacific Leaders Sustainability fund embeds sustainability factors into every part of its analysis, with a focus on companies that are positive to the social and economic aspect of the country in which they operate. An example of its holdings is CSL, an Australian healthcare company that develops and manufactures vaccines and plasma protein biotherapies, which support SDG 3 Good Health and Well-being and SDG 10 Reduced Inequalities.

- The Renewables Infrastructure Group aims to generate sustainable returns from investing in green energy infrastructure. Their dedicated sourcing team look to purchase mostly solar and wind assets in the UK and Europe. Annually, the portfolio is capable of powering over 1.3 million homes and saving 1.6 million tonnes of CO2, directly contributing to SDG 7 Affordable and Clean Energy, and SDG 13 Climate Action.

Finding new approaches

The future of sustainable investment is fast evolving and we are determined to always be at the forefront. Finding inspiring initiatives and new ways of working is a vital part of this. We’re currently looking into a fund management approach to addressing global environmental challenges, based on the belief that climate philanthropy is the best way to magnify our impact. We are exploring portfolios that offer a selection of diverse charities and not-for-profits meaning that funds can work quickly and directly to make real changes, such as enforcing environmental laws or combating deforestation.

Earth Day offers us a moment to stop and really consider how we live. What changes can we make for the environment, and how can we truly invest in our planet? Could sustainable investing be your way forward?

1. Earth Day 2023 – Earth Day

2. EARTHDAY.ORG Announces Theme for Earth Day 2023: “Invest in Our Planet” – Earth Day

3. Earth Day 2023 – Earth Day

4. Earth Day 2023 – Earth Day

5. For example, since its launch in 2014, Holden & Partners’ Sustainable Balanced Portfolio has consistently outperformed the industry standard Investment Association Mixed Investment benchmark. Past performance is not a guide to future returns. The value of investments can go down as well as up and you may get back less than they invest.

6. https://www.holden-partners.co.uk/the-sustainable-development-goals/