Mixed Signals

Holden & Partners Quarterly Investment Views: Q2 2019 Outlook

by Amelia Sexton

After a bullish start to the year in which assets rebounded from their December lows, the prospect of a global recession was once again brought to the forefront of investors’ minds at the end of the first quarter. The inversion of the US yield curve – a phenomenon whereby short-term interest rates, and thereby the yield on US government bonds, move above longer-term rates – has been interpreted by some as an expectation of weaker long-term growth, although other commentators have questioned whether the trend was clear enough, or persisted for sufficient time, to become a reliable predictor of recession. Add to this the fact that slow, but positive, global growth, the Federal Reserve’s renewed dovish stance (support for lower interest rates due to diminishing concerns on inflation), and a more conciliatory approach between China and the USA on global trade has supported equities year-to-date, and it’s clear that markets are generating extremely mixed signals.

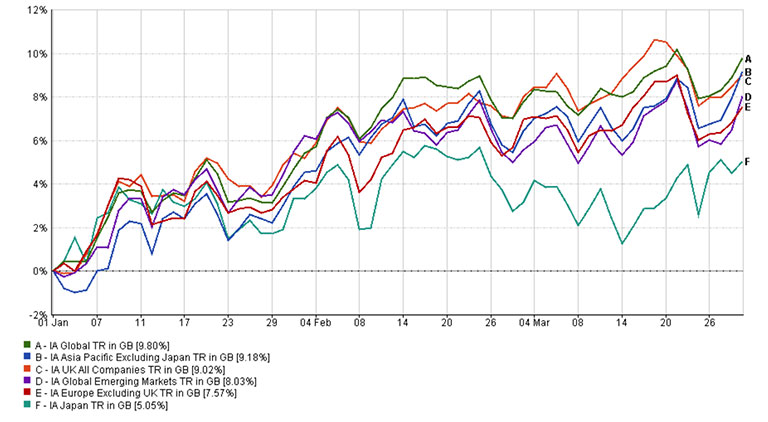

Source: FE Analytics. Chart shows the performance of various Investment Association (IA) equity market sectors YTD to 31.03.2019

Despite the inconsistencies between equity and fixed income markets, we wish to reiterate our view that a global recession during 2019 remains unlikely. As we have mentioned previously, we are mindful of the fact that growth is slowing, and that the extended post-crisis expansion is in its latter stages but believe that there is enough strength in the global economy to provide opportunities for risk assets in the near term. Q1’s equity rally represented a sharp reversal of the nervousness that permeated markets in the last quarter of 2018, as well as concerns that aggressive policy from the Fed would cause an imminent slowdown. Expectations of future growth, and valuations, became more reasonable as a result. This coincided with the reintroduction of more supportive monetary policy to provide an opportune environment for equities to outperform; slower but steady growth, controlled inflation, and limited interest rate rises may mean that this continues in the short-term.

Headwinds persist however and, as valuations have increased significantly since the start of the year, it would be unwise to assume that the recent rally can be sustained indefinitely. Global growth must remain strong enough to limit concerns of an imminent recession, yet not so strong that it provokes a response from policymakers, leading to tighter financial conditions and a withdrawal of liquidity. Unexpected signs of a slowdown or resurgence in geopolitical risk could throw equity markets off-balance and have a damaging effect on sentiment.

It is for this reason that we continue to advocate taking a longer-term perspective; attempting to predict the timing of the next recession is challenging, but increasing the resilience of portfolios, whilst ensuring that we do not miss out on growth opportunities at the latter stage of the cycle, is a prudent measure. Balancing risk and reward within a portfolio is therefore essential. Rapid increases in asset prices and a corresponding decrease in volatility may provide an opportunity for investors to de-risk and take profits, whilst short, sharp corrections may enable them to increase their allocations undervalued parts of the equity market. Positive economic surprises are possible and

With these factors in mind, our current views by asset class are as follows:

UK Equities – Neutral

The UK continues to present a conundrum for equity investors: a resolution to the current stalemate and passage of ‘softer’ Brexit compromise would prove beneficial for the economy but result in an appreciation of the currency that would challenge the more globally-focused stocks in the index (earnings generated in foreign currencies decrease in value as Sterling strengthens). It would provide a more favourable backdrop for domestic companies, although any relief rally could be limited by a swift increase in interest rates that may accompany any Brexit deal. The opposite would be true in the event of a ‘no-deal’ – although this is becoming increasingly less likely – with further Sterling depreciation favouring international cashflow generating firms. All parts of the market offer an attractive income yield when compared to UK gilts and other global equity markets.

Global Equities – Neutral

A slow, but still expanding, economy will be positive for global stocks, although fluctuations in value should be expected depending on the probability of a US recession or escalation of political risk at any given moment in time. Any further escalation in trade tensions or geopolitical risk would undermine business confidence, requiring investors to demand a higher premium to hold riskier assets.

The Fed’s patience in implementing its next rate hike has extended the ability for all equity markets to perform relatively strongly towards the end of the economic cycle. We therefore possess a neutral position to the asset class but avoid any large regional or style over- or under-weights to prevent favouring certain markets based on short-term divergence. Unexpectedly high earnings remain supportive of markets in the US, but valuations are relatively high, while easy monetary policy in Europe may go some way to offset weaker economic momentum and political headwinds. Quality companies with strong balance sheets often perform most favourably in a late-cycle environment so we advocate retaining exposure in this area.

GEM Equities – Overweight

Emerging market growth has proved robust year-to-date and is likely to continue to be supported by policy stimulus, economic reform, improving corporate fundamentals, and reasonable valuations. Improved consumption and economic activity from Chinese stimulus have underpinned global growth so far this year and could help offset any trade-related weakness. Stronger current account positions in many areas (particularly emerging Asia) reduces vulnerability to capital flight. A worse-than-expected Chinese slowdown or disruptions in global trade would pose significant risks for the asset class however, and short-term volatility is therefore likely.

UK Bonds – Aggressive Underweight

Sovereign debt is one of the few asset classes not dependent on corporate profitability to generate returns and UK Gilts therefore prove to be relatively certain diversifiers against equity risk. They also provide a suitable hedge to ‘hard’ Brexit although this scenario is becoming less likely with the current cross-party negotiations. A rising rate environment, which would likely occur in the event of a softer Brexit, would put pressure on yields and be highly unfavourable for prices, thereby cementing our underweight position.

Index Linked Bonds – Neutral

Read more about our views on Index Linked Bonds here.

Global Bonds – Underweight

Whilst a rising-rate environment is typically poor for fixed income instruments globally, yields now appear range-bound thanks to the Fed’s supportive rhetoric and lower growth expectations. Spreads (a measure of credit risk represented by the yield premium over that of an equivalent government bond) on investment grade corporate, and high yield, debt have fallen back significantly since the policy change, but opportunities remain in selective areas. We maintain our position in global bond funds with a strategic, unconstrained approach so duration and credit risks can be actively managed and are likely to increase our allocation to global fixed interest using the proceeds from a reduction in absolute return assets in the coming quarters.

Absolute Return – Overweight

Read more about our views on Absolute Return here.

Property – Overweight

Read more about our views on Property here.

Infrastructure – Overweight

Infrastructure assets continue to constitute important components of the lower risk and income-orientated portfolios due to their yield superiority over traditional fixed interest, and diversification characteristics which ensure a low correlation to both equity and bond markets.

Commodities – Neutral

Resilience in the Chinese economy has supported resource and commodity stocks year-to-date and has benefitted our position in the Blackrock Natural Resources Growth & Income fund. Any progress in trade negotiations between the US & China would likely provide further upside, particularly for the oil price.

We continue to advocate holding a blend of resource-related equities alongside gold and other precious metals. These real assets typically act as ‘safe havens’, thereby providing downside protection should economic growth become unexpectedly weak and equity markets experience a resurgence in volatility. Lower bond yields and limited future upside in the US dollar is supportive of this view.

Content of the articles featured in this publication is for your general information and use only and is not intended to address your particular requirements. They should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent finance acts.