UK Commercial Property

Holden & Partners Quarterly Investment Views: Q2 2019 Outlook

We remain positive on the outlook for UK and European commercial property for the following reasons:

- High and stable yield – Commercial property assets offer the potential for capital growth alongside a secure level of income derived from rents paid by the underlying tenants. In a low interest environment, such as that experienced in many developed economies today, these stable yields become considerably more attractive, particularly as they surpass that which can be achieved on sovereign debt, another traditional source of reliable income. As the economic cycle matures and growth slows, the durability of these income payments, as well as the level, becomes more important. Fortunately, the UK commercial property market benefits from a long lease structure (typically 10-15 years), lower default risk than that of residential property, and contracts that allow for upward-only rent reviews. These measures provide rental income that remains constant for an extended period and, as such, is relatively secure compared to other asset classes. Capital growth can be extremely cyclical, but a high and sustainable yield generally make property funds an attractive compounder of returns over the long-term.

Whilst it is true that the yield superiority of commercial property over fixed income has narrowed in recent months, we believe that the differential is still substantial enough to justify our allocation to property assets. - Inflation protection – Unexpected inflation surprises become more likely as the global economy enters a ‘late-cycle’ phase, so a degree of inflation protection becomes increasingly desirable for investors. Equities and bonds tend to respond negatively to inflation surprises as their cashflows do not rise with the general increases in price. However, the price of real assets such as property tend to increase at a similar rate, thereby resulting in positive relative performance versus other securities. The upward-only rent reviews on many UK commercial properties is an example of the measures in place to ensure that rental income increases by at least inflation each year.

- Diversification – Commercial property offers significant diversification benefit when used within a multi-asset portfolio due to its low correlation with equities, fixed income, and cash. The performance of property funds depends primarily on the stability of their rental income along with periodic valuations of the underlying assets, meaning they are less affected by volatility in global stock markets and move independently of other assets.

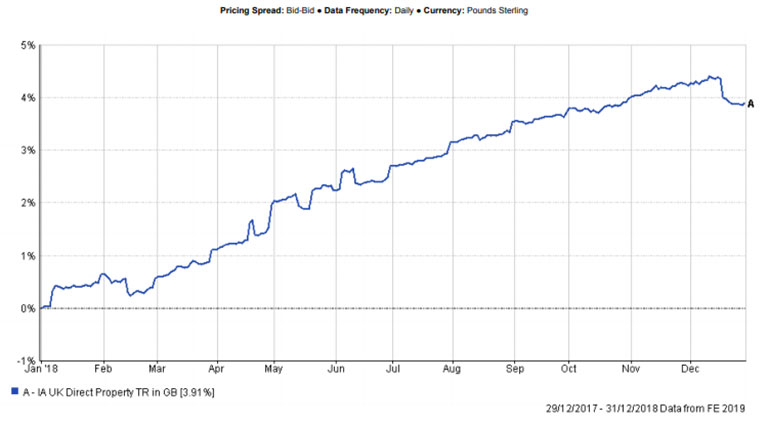

In 2018, UK Direct Property was the best-performing Investment Association sector, returning 3.91% at a time when major stock market indices struggled to generate positive returns. Despite concerns over Brexit, this performance suggests that the UK commercial property market remains attractive given its sound legal system, transparency and high quality, alongside the fact that Sterling’s decline has reduced the cost of assets to foreign investors significantly.

All this being said, we are not blind to the mounting headwinds for the asset class. The outlook for capital growth has become more uncertain both due to political uncertainty and declining economic growth, as well as the deterioration in value of retail assets over the year and changing habits within the office sector. We address these concerns by ensuring that the managers of the funds we use take account of structural changes in the property sector and allocate within their portfolios accordingly. The current positioning of both of the open-ended funds we invest in (Aberdeen Standard and Henderson) are based on the following fundamental themes:

Investment in ‘Brexit immune’ areas and a bias towards industrial properties:

- ‘Brexit immune’ sectors are those supported by long-term structural trends that will not be negatively affected by a deterioration in the macroeconomic environment (care homes, student accommodation and data centres) and therefore tend to hold up well in a downturn

- Industrial space in the South East remains in favour due to the perceived supply and demand imbalance in the sector

Recognition of the ‘death of retail’ and the avoidance of vulnerable properties/areas:

- Retail may form part of the funds’ allocation, but critical importance is given to quality within the space

- Quality is a subjective term, but the credit worthiness of tenants, consistency of ‘foot-fall’ (i.e. consumer traffic) and location are all key considerations within the retail holdings within the funds

- The managers note that shopping centres in prime, central locations have not experienced significant drop-offs in terms of business activity, and these are assets which are focussed on

- The broad decline in traditional retail shopping is countered by owning and planning to increase allocations to retail distributions centres (warehouses) which stand to benefit from the ongoing shift from high street to online shopping

Acknowledgement of the structural shift away from the conventional office model and towards office contracting:

- The funds carry an almost-negligible allocation to London offices, for which the reasoning two-fold:

➢ London is the most susceptible UK office market to the ‘We Work’ effect

➢ Should a hard Brexit scenario unfold, UK financial services will likely suffer, and so too will London City office space. It is thought that more than 100,000 City workers could relocate to Europe in the event of a hard Brexit - The funds do maintain exposure to some office space, however quality is of paramount importance, both in terms of tenant stability and location

The two funds are therefore quite defensively positioned and maintain a focus on diversity of assets and low vacancy rates, as well as an active avoidance of more cyclical areas of the market, such as London office space and leisure parks. They also carry cash weightings of circa 20% which are in place both as a liquidity provision to meet withdrawal requests, and as a tool to make opportunistic purchases should these arise with a correction in the market.

Although our view on the asset class has not changed, we are cognisant of the issues that arise when illiquid assets such as property are accessed through open-ended funds (products that create or cancel units depending on demand) which allow daily dealing in units. This fund structure can cause issues when sentiment on UK property changes unexpectedly and the manager experiences large outflows; although the units in the fund can be sold within a day, the underlying physical property assets take much longer to liquidate and cannot be sold gradually, resulting in declining cash reserves and, eventually, an inability to meet redemptions. In such instances, the managers may act to protect those who remain invested in the fund by altering the price structure or suspending trading completely, which occurred in June 2016 in the aftermath of the Brexit vote. Whilst such action does not alter the underlying value of the properties held – it actually prevents the rapid selling of properties at unfavourable prices to facilitate redemptions – we understand that it can be distressing for clients, particularly if withdrawals are required during the period of suspension.

A solution to this dilemma is to use open-ended funds in conjunction with closed-ended investment trusts (instruments which have a set number of shares traded on an exchange) such as TR Property, much as the H&P investment team do at present. The TR Property fund invests in the UK & European property markets primarily through pan-European listed equities (a much more volatile, yet more liquid, asset class), with minimal exposure to direct UK bricks & mortar. The blend of these two types of funds together therefore provides diversified exposure to the asset class, which we believe will continue to benefit portfolios going forward. We remain conscious of allocating too heavily to exchange-traded property funds because, whilst they benefit from the liquidity of an equity-like product, they also suffer from the same levels of volatility as the stock market.

As the UK moves closer to its EU withdrawal date, concerns have been raised about how the commercial property market will respond to a ‘no-deal’ Brexit: fears which were exacerbated by the outflows experienced by a variety of open-ended funds in December 2018. We believe that further trading suspensions are a possibility given the current political turmoil, although not necessarily likely due to the high cash levels possessed by managers and the relatively minor level of withdrawals experienced thus far (compared to June 2016). Both managers, and investors, have the foresight to act in a more timely and controlled manner should similar liquidity concerns manifest themselves this time around.

Nevertheless, as a result of the concerns around open-ended funds, we will be altering the balance of our exposure to these two types of property products in the coming months: gradually reducing that to the open-ended funds and increasing that of the exchange-traded investment trusts, without concentrating the allocation too heavily in either structure. We anticipate reaching a split of 50:50 between these structures in due course and believe this leaves investors well-placed to generate modest, yet attractive, returns from property over the coming years.

Content of the articles featured in this publication is for your general information and use only and is not intended to address your particular requirements. They should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent finance acts.