The Rise of Eco-Awareness

It’s fair to say issues surrounding the environment, the future of our planet and the sustainability of the world’s actions have been receiving an increasing amount of attention over the past 18 months. Key figures such as David Attenborough, Greta Thunberg, the Extinction Rebellion and, more recently, the devastation across Australia caused by bush fires, have had a significant impact in raising this awareness with investors now becoming increasingly concerned not just for their financial future but for the future of the globe.

At Holden & Partners, we believe investing for future financial gain and investing in an ethical, sustainable and thematic (EST) way can go hand in hand. Whenever a person chooses to invest, the value in this investment lies in future cash flows. It is not unreasonable to assume that a company that takes a long-term and sensible approach to factors such as sustainability, building corporate governance and delivering other non-financial benefits are more likely to deliver on these future cash flows as they are less exposed to risks such as regulatory changes or public opinion.

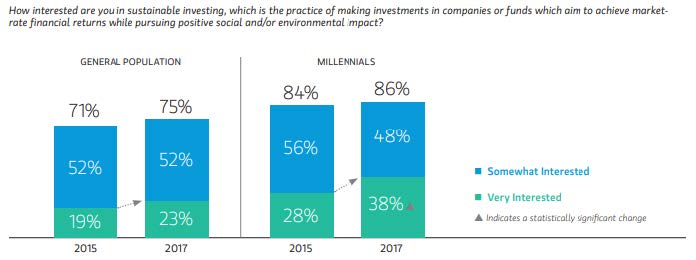

Recent growth in ESG investing (environmental, social and governance) suggests many others share our view. A report by Triodos bank forecasts a 173% growth in in this area1 by 2027. The report suggests there is an increasing appetite among existing investors but the main driver behind this growth is coming from younger investors between the ages of 18-34 with 56% of millennials saying they have invested in an ethical fund as a result of something they have heard on the news. This is further supported by a Morgan Stanley study which shows that 75% of the population in the US have an interest in sustainable investing and 86% of millennials as depicted below2.

This increase in interest is not random. As alluded to earlier, regulatory pressure and an increase in awareness thanks to an ever more accessible amount of information and influencers such as Attenborough and Thunberg have led the way. Over 14 million people watched Blue Planet II and demand for ESG investments is higher than ever with CityWire reporting a “boom” in ESG fund sales in Q3 2019 despite a tough quarter elsewhere3.

The rise in activism has resulted in a positive domino effect. Consumers are rejecting companies whose practices are not only negative but also do not take steps to have a positive impact. This causes companies to change their practices meaning the competition must respond in kind. Identifying trends such as this forms a large part of the T (Thematic) in our EST approach to investing. The aim is to determine what will influence financial markets in the future and the way we live our lives. This move towards sustainability has only recently come to the fore but is something that has been growing for a while now.

Investors now have an opportunity to seize the power of money for positive change as consumer pressure is the most powerful force for progress and figures suggest this is happening. Morningstar reported that flows into sustainable funds have set calendar-year records for each of the past three years with 2019 on track to continue this trend4. In Schroders annual sustainable investing report, they highlighted how 60% of all investors believe sustainability factors should be integrated across all investment products regardless of mandate5. At Holden & Partners, we believe in the near future, ESG factors will be embedded across all funds.

The motivations behind ethical investing are not just down to a growing desire to have a positive impact but there are an increasing number of studies that show a positive correlation between ESG and financial performance6. Data and analytics are evolving, as a result, companies provide better quality data which can be combined with better quality ESG research and analytics capabilities. This means we are seeing more financially relevant approaches being taken towards ESG investing. ESG analysis now forms a large part of valuing a company and measuring their performance. This has led to some companies adapting their practices to ensure they aren’t left behind by the competition. A study by KPMG showed how one-third of the board members interviewed indicated that investor pressure had increased the company’s focus on ESG7. Furthermore, with growing geopolitical uncertainty and rising economic tensions it has become clear that ESG criteria are better suited to assessing an organisations long-term sustainability and capacity for growth. ESG analysis relies less on past performance and historical data as a predictor of future performance and focusses on a forward looking, expansive approach to investing.

However, having an interest in sustainability and ethical investing is not the same as investing in funds or companies that actively make ESG part of their ethos. The Morgan Stanley study mentioned earlier reports that of the 75% interested in aligning their portfolios with their values, only 38% have moved to do so. Historically, ethical investing has been viewed as a niche area where values and beliefs rank ahead of wealth maximisation and as a result many ignore it. Although the figures in the studies mentioned earlier suggest this may change in the coming years, investors want to see more. This has led to a change in approach in the asset management industry. Traditionally, ethical investing involved a negative screen where companies were excluded if they did not comply with a specific set of environmental criteria e.g. tobacco companies, armaments, gambling etc. There is now an increased demand for this to go further which has led to the rise of positive screening and impact funds. This means rather than excluding companies, investors can choose to invest in companies that set positive examples of environmentally friendly products and services, are socially responsible, or come up with innovative ways to enhance the world’s sustainability. Impact investing takes this one step further by measuring the positive social and environmental impact alongside the financial return. This means investment analysis now needs to look deeper into potential investments to ensure they aren’t just labelled as sustainable and that potentially investable companies and funds are taking proactive steps to measure the impact of their investment on society and the environment.

There is good reason to be optimistic for the future, but more capital is needed to unlock the potential of ESG and impact investing8. At Holden & Partners we are proud to have been advising on ethical and environmental investment for 15 years now. It has always been an essential element of Holden and Partners; it’s an area in which we have specialised in since our inception. Many of our clients now realise that their money can have a meaningful and sustainable social and environmental impact as well as providing financial growth.

Content of the articles featured in this publication is for your general information and use only and is not intended to address your particular requirements. They should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice. Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles. Thresholds, percentage rates and tax legislation may change in subsequent finance acts.

Footnotes

1 https://www.triodos.co.uk/articles/2018/a-tipping-point-for-ethical-investing

4 https://www.ft.com/content/2c7b8438-a5a6-11e9-984c-fac8325aaa04

5 https://www.schroders.com/es/sysglobalassets/about-us/sustainable-investment-report-annual-2017.pdf

6 https://www.msci.com/www/research-paper/foundations-of-esg-investing/0795306949

7 https://assets.kpmg/content/dam/kpmg/be/pdf/2018/05/esg-risk-and-return.pdf