Messages from Market Volatility

Few investors would refute the fact that the positive global macroeconomic environment over the last few years has been extremely favourable for equity markets. 2017 alone provided the model backdrop of synchronised global growth on a consistent upward trajectory, rebounding international trade, benign inflation, surging corporate profitability, and well-articulated messages from global central banks regarding their intentions on policy tightening and interest rate hikes. It was a ‘Goldilocks’ scenario; a unique period, the first of its kind since the financial crisis. Growth was strong, but not so hot that it caused rampant inflation, nor too cold that it resulted in a slowdown, or even recession. Renewed optimism in the previously unloved bull market, alongside recovering corporate earnings, pushed many markets to new highs and financial market volatility to unprecedented lows.

History teaches investors not to assume that such supportive environments can persist forever, or to become complacent regarding risk. It is not ‘different’ this time, nor is it likely that it ever will be. Risk assets had performed very well by the end of 2017, and perhaps justifiably so given the economic context, but the past few months have demonstrated that volatility can return at any time. Whilst markets in general may not have reached the sort of excessive levels that typically signal the end of the business cycle, or a period of ‘irrational exuberance’1, the assumption that prices would continue to be supported by mild inflation, supportive monetary policy, and stable upward price movements, was a fragile one, with certain areas meriting a more cautious stance.

For us, at Holden & Partners, the implication for 2018 was that, as valuations across the globe become less appealing, the focus of investors will be set firmly on genuine growth. The events of February, whereby surging US wage growth and increasing Treasury yields spurred fears of higher inflation, that may require the Federal Reserve to raise interest rates more quickly than expected, demonstrated that global markets are now taking a very unforgiving view with regards to any blips in economic and corporate data. Further share price increases through multiple expansion, or any factor which does not reflect underlying fundamentals, will not be sufficient to drive equity markets much further forward from their current levels.

This is not particularly surprising given the relatively full valuations prevalent in many regions and the fact that, after a prolonged expansion phase of growth and low inflation, the global economy has entered the reflationary stage of the business cycle, which will be followed (at some point) by a slowdown. It is therefore likely that 2018 will be characterised by greater volatility in financial markets, which supports a preference for globally-diversified, active portfolios, with an emphasis on areas experiencing sustainable, and structural, growth.

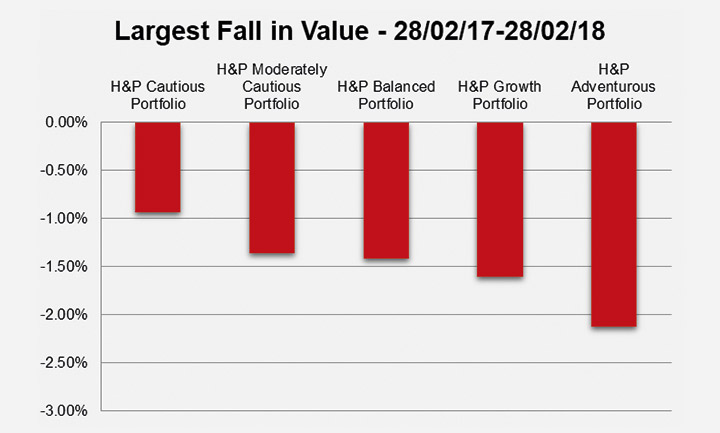

The chart above illustrates the largest consistent fall in value, from peak to trough, experienced by several Holden & Partners model portfolios, each for a differing risk profile, over the past year. Although this timeframe incorporates the recent sell-off, is it evident that each strategy fell to less of an extent than the main market indices, demonstrating the crucial role of diversification between asset classes and geographies in aiding downside protection. Given the current interest rate cycle, we retain our underweight stance to fixed interest, particularly sovereign debt, preferring instead to allocate to property and alternative asset classes, such as infrastructure.

The provision of a stable and secure income, as well as a degree of inflation protection, tends to make these holdings attractive compounders of returns over the long-term. We also advocate incorporating some exposure to absolute return funds, particularly long-short strategies, which typically have very low net equity positions (meaning that the short positions cancel out almost all of the long equity exposure), and therefore are less vulnerable to changes in global stock market indices.

It is important that investors do not lose a sense of perspective regarding recent market movements. The overriding macroeconomic environment is still one of support for equity markets as global growth continues apace, and earnings momentum remains strong amongst corporates. Such ‘corrections’ – declines of 10 per cent or more – represent a level of volatility that should be commonplace in a prolonged bull market, with many of the latest falls only eliminating gains that had been earnt in the latter half of 2017. Whether such volatility is indicative of a ‘new normal’ for markets or an isolated event, it is a vital reminder of just how quickly the environment can change. At Holden & Partners we retain our cautiously optimistic outlook and a focus on ensuring that, should the risk dynamics of the market alter significantly, clients’ portfolios are well-prepared for the potential outcomes.