Market Commentary H1 2017

The first half of 2017 continued in a similar vein to the latter stages of 2016; an extremely supportive period for markets in which numerous global equity indices reached all-time highs. Investors witnessed robust gains in Q1 especially, driven by a raft of positive economic data and the perception of a stronger global recovery. Further advancement was seen in Q2, although movements in the latter stages of the period became more nuanced as investors distinguished between improving corporate earnings and economic data in Europe, and a slight disappointment in expectations in the USA. In contrast to recent years, political and economic surprises were not accompanied by an increase in market volatility – in fact, the VIX index (measuring the volatility of the US equity market) reached its lowest level since 1993, perhaps suggesting that investors are now focusing more heavily on underlying economic growth than the instability created by specific events.

2017’s pro-equity environment started with President Trump’s inauguration in January, as markets were buoyed by the administration’s plans to cut taxes, reduce the regulatory burden on companies, and increase infrastructure spending, alongside the expectation of higher GDP growth and inflation. Nonetheless, the so-called ‘reflation’ trade started to lose momentum within a few months as little progress was made on implementing the reform agenda, with the failure to pass revisions to healthcare legislation in March demonstrating Trump’s inability to deliver on many of his policies. With this came the realisation that a large boost to economic growth was unlikely, and the subsequent unwinding of the rally in value-orientated stocks which had surged since the election result. That being said, equity valuations continued to rise on the back of positive economic data, although this became softer in Q2 as several leading indicators disappointed. The Federal Reserve (Fed) looked through low inflation readings to further tighten policy with a 0.25% interest rate rise in June, whilst the dollar weakened due to a lack of conviction over the success of fiscal expansion and the expectation of other central banks around the world withdrawing monetary stimulus.

Europe was, once again, preoccupied with political developments in the early months of the year, with the Dutch election in March being the first anticipated event, followed by the French equivalent in June. Investors responded positively to both results, particularly the appointment of President Macron and the possible implementation of numerous reforms, alongside less risk of EU break-up. Such diminishing political headwinds appeared to spur renewed confidence in the region, which manifested itself in the form of increased flows into European equities. Positive economic data, in the form of both increased exports and greater manufacturing and services momentum, as well as improved corporate earnings, also supported share prices throughout the period.

In the UK, the first quarter of the year was characterised by the continued outperformance of cyclical sectors as the domestic economy proved surprisingly resilient in the wake of the Brexit vote. The environment changed significantly in Q2, however, with the announcement of an unexpected general election based on Theresa May’s desire to seek a mandate for her version of a ‘hard Brexit’. In the event, a weak Conservative Party campaign and a high youth turnout meant that a hung parliament became ever more likely, and the state of the economy ever more precarious, with Sterling coming under considerable pressure. Inflation hit a four-year high of 2.7% in April, resulting in lower real wage growth which fed through to weaker consumer spending and weighed on UK domestically-focused industries, particularly the retail sector. The nature of Brexit negotiations, which started at the end of the half, remains uncertain, although it is expected that the government will take a softer stance than originally planned. Nevertheless, the likelihood of discussions breaking down, or another election being called, remains relatively high.

A surprising feature of the period was that market expectations for continued rises in long-term interest rates were not met. The assumption was that rate rises were more probable on both sides of the Atlantic given the resilient performance of the UK economy post-Brexit, and the inauguration of the Trump administration, signalling a shift away from expansive monetary to fiscal policy. Despite this, yields slipped to levels seen in mid-2016 in the UK due to a decline in economic data, and remained relatively stable in the US despite two rate rises in the period, as inflation rose much less than expected, thereby providing support for bond prices.

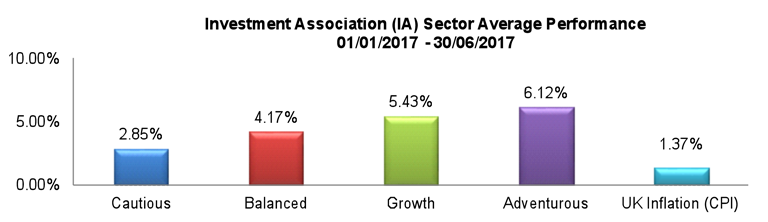

With regard to the average performance of different risk profiles, higher risk mandates outperformed lower risk as per the latter half of 2016, though all achieved positive returns that exceeded inflation:

Sources: Financial Express, Bloomberg

Looking ahead to the latter half of 2017, the investment environment is likely to remain one of support for global equity markets; the recovery in global growth looks set to persist, as manufacturing and services Purchasing Managers’ indices (PMIs) increase in tandem with the level of global exports, whilst inflation, in many regions, rolls over from its Q1 peak, implying that accommodative monetary policy may continue longer than previously expected. Despite this, it is important to be mindful of the starting point for equities in terms of both valuation and corporate earnings, as some markets have the potential for greater upside than others. As such, correlations between different equity assets are likely to decline to lower levels than that of previous years.

The US is a region in which valuations look relatively rich on standard measures such as price-earnings ratios, as well as average corporate earnings which have exceeded pre-crisis highs. Although this may be attributable to the advanced nature of the economic recovery and the high-quality characteristics of the market, further interest rate rises by the Fed could put pressure on corporate profit margins, limiting earnings growth for the remainder of the year. That being said, the technology sector has consistently beaten earnings expectations and, if this continues, it has the potential to drive the market even higher. Fiscal expansion would also be supportive of current equity prices, but investors’ expectations of Trump’s success in implementing such policies has diminished significantly over the first half of the year.

Continental Europe looks set to be the most attractive region in terms of return potential. 2017 has seen a vast improvement in corporate earnings, which are rebounding from a low base (below pre-crisis levels), as many analysts continue to revise up their forecasts from the start of the year. The macroeconomic environment is positive which has led to greater growth forecasts, monetary policy is likely to remain accommodative as long as inflation does not rise sharply, and political issues have dissipated to the extent that the greatest threat to the region is now emanating from the UK and Italy. Indeed, the recent European election results are regarded as pro-growth developments, renewing confidence in equities to outperform their developed market counterparts, especially given their relatively low valuations.

With regards to Brexit, the full effects are yet to be understood although the immediate impact is widely assumed to be negative, particularly for the UK domestic economy. Higher inflation and weak business investment, due to increased uncertainty, has already started to squeeze consumer spending: a problem likely to persist for domestically-focused sectors in the short-term. Nevertheless, the outlook over the medium-term has improved following the failure of the Conservative Party to gain majority in general election, thereby increasing the likelihood of a ‘softer’ exit from the EU via a transitional arrangement and possibly a free trade agreement, which would be less disruptive economically and support equity valuations.

In the emerging world, an upswing in global growth and trade, as well as the Trump administration’s failure to follow through on protectionist policies, has provided a favourable backdrop for markets that should continue into the second half of the year. This, alongside comparably low valuations and the dissipating headwinds from a stronger US Dollar, may facilitate the outperformance of emerging market equities versus their developed market counterparts. As ever, the key threat is the risk of a hard landing in China. Whilst this is a possibility, the Chinese authorities appear to be aware that the economy is facing a structural slowdown and are intentionally tightening credit conditions to ensure a smooth transition to this new phase of growth. As long as the current policy of monetary tightening does not limit the availability of credit to the extent that it strangles growth completely, it is feasible that they will be successful in this aim.

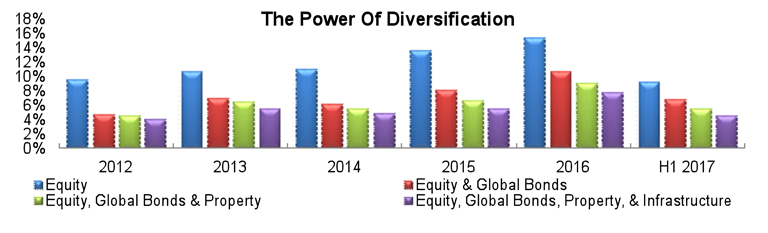

Regardless of the macroeconomic environment, geographical and asset class diversification remains crucial. The chart below illustrates that, for the past five and a half calendar years, adding further asset classes has reduced overall portfolio volatility, highlighting the power of diversification.

Chart measures portfolio risk. Equity – MSCI AC World; Global Bonds – IA Global Bonds; Property – IA Property; Infrastructure – IT Infrastructure. Weekly data points used, all expressed in GBP. For illustrative purposes only.

Sources: Financial Express, Bloomberg, Eurostat