Assessing Brexit

Implications for Investors

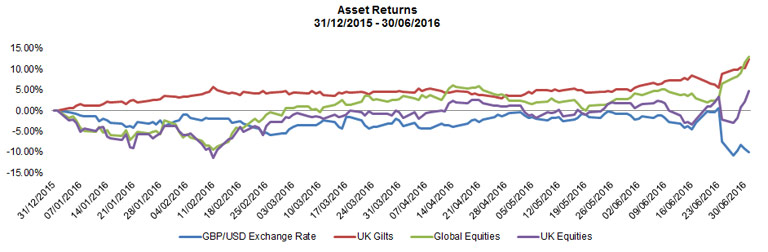

Prior to the EU referendum result, investors had witnessed an extremely volatile environment in the first half of 2016, attributable to a complex array of factors. Global equities retreated significantly in February due to concerns surrounding a slowdown in global growth, exacerbated by the weakness in Chinese economic data and Yuan devaluation, as well as a persistently low oil price, which markets seemed to interpret as a sign of scant consumer demand. All of this took place against a backdrop of rising US interest rates, which resulted in an unlikely scenario of monetary tightening in the world’s largest economy, with the remainder of the globe struggling to generate meaningful growth of any sort. Risk aversion and volatility reached near-term highs, although this now pales into insignificance when compared to the instability created by the Brexit vote in the final weeks of June, particularly for UK investors.

At the time of writing, the overriding feeling within financial markets is one of uncertainty. It is likely that large daily price swings witnessed in the days following the result will continue over the coming weeks, or months, as assets find their new equilibrium level. The extent of these movements will depend largely on the policy response from governments and central banks, not only in the UK but also in Europe, the full significance of which will only become apparent over time. The manner in which the negotiations are conducted will be crucial in determining the UK’s future relationship with Brussels, yet these cannot begin until ‘Article 50’ is triggered to signal the start of a two-year discussion period, a development which still seems a long way off given the current political vacuum in Westminster. Whilst it is impossible to accurately predict the outcome of the current impasse, assessing what is priced into markets and taking advantage of the opportunities that present themselves is crucial for investors wishing to navigate such turbulent times.

In the immediate aftermath of the result, the most severe ramifications were witnessed in the currency markets in which the Pound plummeted against almost every tradable currency, particularly the Dollar against which it breached a 31-year low of $1.3224. It then rebounded to the $1.35 level but is likely to remain under pressure for some time. Whilst the weakness of Sterling is set to persist, and has significant implications for import prices, which will rise, and consequently inflation, which could increase rapidly, there are also a number of beneficiaries of the recent exchange rate movements. For example, UK companies earning a large proportion of their revenues overseas, including many of the mega-cap constituents of the main equity indices, will profit from the increased value of their operations abroad. Recognition of this fact was demonstrated in the initial market movements after the vote, in which the share prices of global, defensive companies withstood the volatile conditions well, even rising in some circumstances. Likewise, global and emerging market equity funds priced in Sterling benefitted greatly from currency movements, with some rising over 5% in a single day after the result, thereby compensating for losses experienced elsewhere. Gains such as these should therefore reinforce the importance of maintaining a well-diversified portfolio with global exposure, particularly during periods of significant market instability.

As expected, the more domestically-focused UK stocks, for which currency movements are not such a tailwind, bore the brunt of the market turmoil, with UK banks and housebuilders the most severely affected. It will take time for these companies to find their new equilibrium price levels, which may present several compelling investment opportunities, but above all, the emphasis for clients should be on retaining exposure to a diverse range of asset classes in order to minimise stock-specific risk, and limit volatility to an appropriate level given each individual investor’s risk tolerance.

Bond markets were not able to escape the effects of the instability either, with gilt yields declining sharply to an all-time low of below 1% as markets attempted to digest the impact of Brexit on the UK economy. Such severe movements can be attributed to the immediate emergence of a ‘risk-off’ sentiment amongst investors, prompting a flight to the perceived safety of UK government debt. Whilst this is understandable in the short-term, the fact that investors are willing to lend to a politically unstable government at a rate lower than ever before is somewhat counterintuitive, and serves to demonstrate the extent of risk aversion currently infiltrating the market. Although it is possible that gilt yields will creep higher over the medium-term in light of the ratings downgrades issued by S&P and Fitch, as well as the need to attract foreigners back to the bond market with higher rates, it is likely that the Bank of England (BoE) will intervene to support markets, maintaining yields at their current levels in order to stimulate domestic growth.

This could potentially be the ‘silver lining’ to the Brexit cloud; if policymakers act decisively to relax fiscal austerity, perhaps through corporation tax cuts or forms of economic stimulus such as infrastructure spending, they will provide support for riskier asset classes. When coupled with the relatively cheap valuations of some sectors in comparison to a few weeks ago, equities now appear very attractive in comparison with most fixed income securities, particularly in Europe, and regions such as Japan, which have experienced significant market fluctuations despite being largely unaffected by the Brexit scenario. Given that volatility is likely to persist, gold may remain in favour with some investors as an insurance policy, although its latest rally limits the scope for further significant gains.

Another area which has come under the spotlight since the referendum, and appears to be of particular concern to retail investors, is that of commercial property. Several open-ended funds have suspended trading in response to large redemptions since the Brexit vote, causing panic amongst investors and precipitating further withdrawals from similar products, thereby fuelling a vicious circle of declines which may continue until sentiment stabilises. Although many property funds consistently maintain a considerable cash weighting, large redemptions in the lead up to the referendum, as well as in its wake, have eroded the available funds to meet investor withdrawals. Instead of being forced to realise cash through property sales, which may not be in the best interests of existing investors, property fund managers have taken the more prudent measure of stemming outflows through fund suspensions. This development may prove unnerving, but it is important to remain cognisant of the benefits of commercial property as a long-term investment; it is a good source of diversification in the context of an overall portfolio, and provides a stable, and inflation-linked, income that is relatively attractive at a time of ultra-low yields on fixed income assets. In addition, demand from foreign investors is likely to remain strong due to favourable exchange-rate movements, which provides some support for property values in the future. That being said, we remain aware of the limitations of property as an illiquid asset class and generally combine our direct open-ended exposure with exchange-traded funds investing in the shares of property-related companies, where we believe there to be significant value at present. Such companies are not structured in the same way as open-ended property funds, and are therefore not subject to the same restrictions regarding suspensions.

The decision by the UK to negotiate an exit from the European Union clearly has wide-reaching implications for financial assets and currencies, as well as the political and economic landscape, both in the UK and across the continent. As always, we are monitoring the situation as it unfolds and will be providing updates to investors as, and when, further information becomes available. Although we are experiencing unprecedented uncertainty, our view is that a diversified portfolio, comprising a range of asset classes, should, over the long-term, provide the best method of navigating the current economic and political turbulence.

Sources: Financial Express, Bloomberg.